Whistleblowing History Overview

Since the first qui tam provision appeared during the middle ages, hundreds of whistleblowers came forward to fight all kind of frauds and scams. The history we’re going to tell you in this article tries to draw a timeline of the evolution of qui tam as well as the beginning and enactment of the False Claims Act (FCA).

Governments around the world spend massive sums on healthcare, defense, and infrastructure to keep society running safely and efficiently. Corrupt individuals and businesses often take advantage of the bureaucracy’s limited oversight capabilities to steal, overbill and cheat the authorities in order to maximize their own business profits. These fraudulent practices create a greater tax burden on citizens, as well as endanger public welfare by lowering the quality of goods and services provided.

Because fraud has always been hard to detect, many nations have historically relied on private citizens to report on corruption, theft, and corporate misconduct. Lawmakers turned to private citizens to uncover and deter illegal schemes as early as the 7th century. The basic principle of those early statutes was to reward individuals a portion of the stolen money they helped uncover, the same assumption that lives on in modern whistleblower law.

The birth of Qui Tam in Medieval England

The concept of whistleblowing on behalf of one’s government dates back to 7th century England. The term qui tam, which today usually refers to False Claims Act cases, is shortened from the Latin phrase “qui tam pro domino rege quam pro se ipso in hac parte sequitur” that translates to “he who prosecutes for himself as well as for the King.” Modern lawmakers adopted the term to be synonymous with whistleblowers who sue corrupt companies on behalf of their government.

The earliest example of this type of ruling dates to 695, in the declaration of King Wihtred of Kent, which explained that “if a freeman works during [the Sabbath], he shall forfeit his [profits], and the man who informs against him shall have half the fine, and [the profits] of the labor.” This declaration represented the first example of a law that allows private individuals to collect a bounty for reporting a violation of their country’s legislation. More similar statutes arose during the next few centuries, due to the effectiveness of their reward provisions in incentivizing citizens to report lawbreakers.

Whistleblowers in Early America

Since its foundation, America has fostered and embraced a culture of civic responsibility in order to protect and benefit the public good. Benjamin Franklin became one of the first American whistleblowers in 1773 when he exposed confidential letters showing that the royally appointed governor of Massachusetts had intentionally misled Parliament to promote a military buildup in the Colonies.

The legislative fundamentals of our modern laws were laid during the 18th century when many state legislatures adopted qui tam rulings. These laws resembled our current ones in that they incentivized private individuals to report wrongdoing for both the benefit of their nation and for their own personal gain. For example, a 1686 Colonial Law of Massachusetts rewarded any inspector who reported fraud in the sale of bread one-third of the collected fines.

Several of the first Federal litigations heard in the United States involved whistleblower claims. However, qui tam laws generally fell out of use around the beginning of the 19th century and would not re-emerge until after the Civil War.

The origins of the False Claims Act during Civil War

During the Civil War, war profiteering and outright fraud crippled both the Union and Confederate armies. Corrupt defense contractors sold the Union Army lame mules, defective ammunition and rifles that didn’t fire, and spoiled rations that caused soldiers to develop scurvy and dysentery.

In order to combat these unlawful practices, Congress passed the False Claims Act on March 2, 1863. The so-called “relators” were allowed to sue a contractor on behalf of the United States, provided they had personal knowledge of the scam. If their lawsuits were successful, plaintiffs were entitled to receive half the money recovered by the government. The FCA’s sponsor, Senator Jacob Howard, strongly believed that paying rewards to whistleblowers, even if they had engaged in the corrupt acts themselves, was the best way to extensively uncover the largest fraudulent schemes. The original ruling proved to be effective at protecting the country’s interests, and it was an inexpensive method to hold those who stole from the U.S. Department of the Treasury liable for their crimes.

World War II: Whistleblowing Declines

The False Claims Act saw a decline in use during the increase in military spending during World War II. Unlike the Civil War era, the U.S. government now had the Department of Justice to investigate and prosecute war profiteers. The Attorney General at the time, Francis Biddle, pursued most corruption and fraudulent schemes through criminal penalties and rarely filed a civil case. As a result, several citizens with legal knowledge would wait at Federal Courthouses to immediately file a qui tam lawsuit whenever the Department of Justice arranged a criminal indictment.

The Attorney General viewed these opportunist claims as “parasitic lawsuits.” He ultimately told the Supreme Court to eliminate the reward provision as he believed they could hurt the war effort. After the Supreme Court rejected his request, Biddle asked Congress to abolish the FCA completely. The legislator ultimately decided to remove the bounty and, more importantly, eliminated parasitic qui tam cases by prohibiting new litigations whenever the authorities already knew about the fraud. As a result of these changes, whistleblower cases all but vanished for the next forty years.

The 1986 Amendments: The Return of Whistleblower Cases

During the 1980’s, malfeasance and unscrupulousness within the military industry again led to calls for a comprehensive federal program to keep them at bay. The Cold War required a massive increase in military and national defense spending. Billions of dollars were spent with little oversight from the authorities, as the U.S. government prioritized its defense buildup above all else. At the same time, the media began reporting on stories of egregiously wasteful spending and corporate abuse, such as when the Navy was infamously billed $435 for a claw hammer and $7,622 for a coffee maker by private companies. According to a U.S. attorney, one military contractor had “grossly inflated prices intentionally” in 45 contracts from 1975 through 1984. By 1985, the four largest defense contractors working with the government had all been convicted of fraud.

In response, the Congress amended the False Claims Act in 1986, to combat this resurgence in criminal schemes. The amendments renewed and strengthened it by restoring the original reward provisions and creating new, stronger protections for those who decided to blow the whistle. The amendments also increased the penalties against companies who defraud the government from double to triple the damages, in addition to a fine of $5,000 to $10,000 for each false claim submitted. Private lawyers also received additional incentives to use their own resources during the investigations.

Modern Whistleblower Laws In Healthcare and Other Industries

For years, the nation’s sole effective whistleblower law was applied almost exclusively against defense contractors but during the mid-1990’s, the rapidly increasing federal budget spent on healthcare led the Department of Justice to begin prosecuting health care providers who defrauded Medicare and Medicaid as well.

The Franklin v. Parke-Davis lawsuit, filed in 1996, was the first time the False Claims Act was used to prosecute private companies submitting bills for treatments that were never approved by the FDA. Since then, this statute has been used to aggressively target all types of healthcare frauds from overbilling to the payment of kickbacks and the off-label promotion of pharmaceutical drugs. Since 1987, over half of all whistleblowing recoveries have been related to the healthcare industry.

The 2006 Tax Relief and Healthcare Act to fight Tax Fraud

The Internal Revenue Service (IRS) estimates that tax evasion and fraud committed by large corporations costs the government $345 billion annually. However, the FCA explicitly prohibits filing cases based on tax fraud, so in 2006 the Congress passed the Tax Relief and Healthcare Act.

In 2007, IRS Whistleblower Office was officially opened, and plaintiffs who provide tips that lead to successful enforcement actions are rewarded at least 15% and up to 30% of the total recovery. The Act also includes several additional protections such as the ability to report tax-related crimes anonymously. The details of a settlement are also kept confidential.

Although still in its infancy, the IRS Whistleblower Office has recovered billions of ill-gotten dollars within its first decade of existence. The largest individual whistleblower award to date was paid under this program to Bradley Birkenfeld who received $104 million for his role in reporting massive U.S. tax evasion aided by the Swiss Bank UBS. Since 2008 the Office has paid an average of over 100 awards annually to relators who filed a claim.

Securities Fraud under the Dodd-Frank Act

In the aftermath of the 2007 financial crisis, lawmakers called for increased regulation of the financial industry that had guided the stock market toward collapse. In July 2010, the Congress passed the Dodd-Frank Wall Street Reform and Consumer Protection Act, which contained the most sweeping overhaul of Wall Street regulations since the Great Depression. The Act touched on every major aspect of the financial industry from large banking to small-scale lenders. The success of the False Claims Act’s whistleblower program also influenced the Dodd-Frank Act’s drafters who wanted to create a similar program for reporting securities violations. The result was the creation of the Securities and Exchange Commission’s Office of the Whistleblower (SEC) on July 21, 2010.

Like the FCA, the SEC Program rewards individuals who report information about criminal activities and accepts tips reporting any violation of the United States’ securities laws, including international violations of the Foreign Corrupt Practices Act (FCPA). SEC Whistleblowers may file their litigations anonymously through their attorneys and are also protected from any retaliation under the Dodd-Frank Act.

The Future of Whistleblowing

Today, whistleblowers reporting all types of fraud, schemes and violations of securities laws, help the government recover billions of dollars each year in ill-gotten profits. 2015 marked the most successful year for the False Claims Act since its inception. This trend is likely going to accelerate.

Recent history among the various programs and the modern trends in enforcement actions suggest the authorities hold all the weapons to obtain large recoveries and provide honest relators with substantial rewards. A representative of the Department of Justice’s Criminal Division recently announced that all future FCA complaints will also be reviewed by the Criminal Division in addition to the Civil Division. This development increases the chance of any one whistleblower case receiving the government’s attention and will likely result in larger recoveries as the real threat of criminal charges influences settlements.

There have been ongoing discussions about creating additional reward programs in other industries since the passage of the Dodd-Frank Act. These incentive-based approaches may have prevented events such as the BP Oil spill where safety rules were ignored or the Volkswagens emissions scandal.

Whistleblower laws have become a prominent part of the American legal landscape as the federal and local authorities have become increasingly reliant on private citizens to help them detect fraud. The government continues to indicate how highly it values the information contributed to it by improving the protections programs and increasing the bounties after each successful recovery.

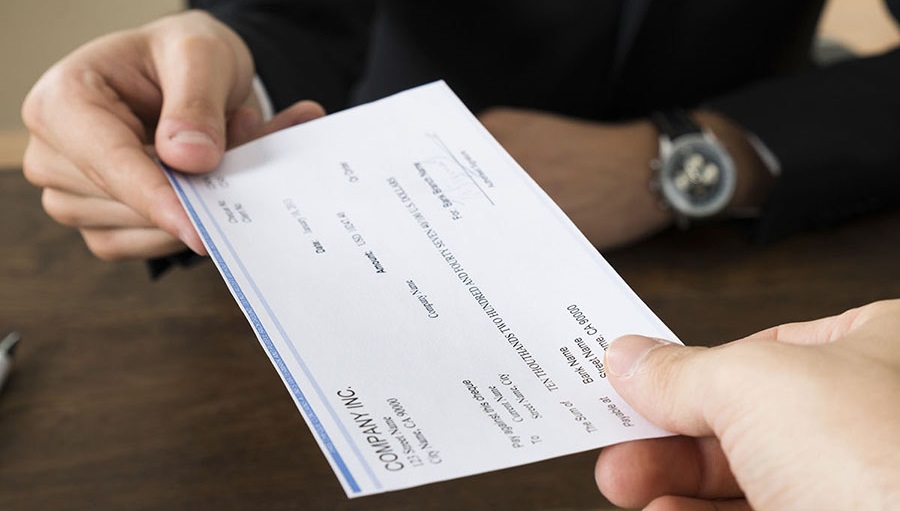

Whistleblower Rewards

Over the past 30 years, the U.S. government has paid over $5 billion in total rewards, with the largest individual payout topping $100 million. We helped many honest citizens blow the whistle. Learn more about the money they earned here

Take the first step

Learn if you’re ready to become a whistleblower and seek advice from our attorneys.

The Whistleblowing Process

Don’t wait to help your country by doing your civic duty – learn more about how to report a crime here.